So, I had a more unusual enquiry last week that I thought could relate to many Teddington residents and therefore worth sharing. A mum who lives in Hampton dropped me an email to ask for my advice on buying an investment property for her daughter who was about to start at Uni. We met for a coffee and discussed the details. Her daughter has just started at Bristol university this September and is currently, as most first year students do, living in Halls. Now, her plan is, instead of paying a landlord an astronomical rent for a tiny 3 bed house, packed with 4 students, where you want to wipe your feet before leaving(!), she wants to become that landlord and provide her daughter and her friends with a decent place to live for her last 2 years of Uni.

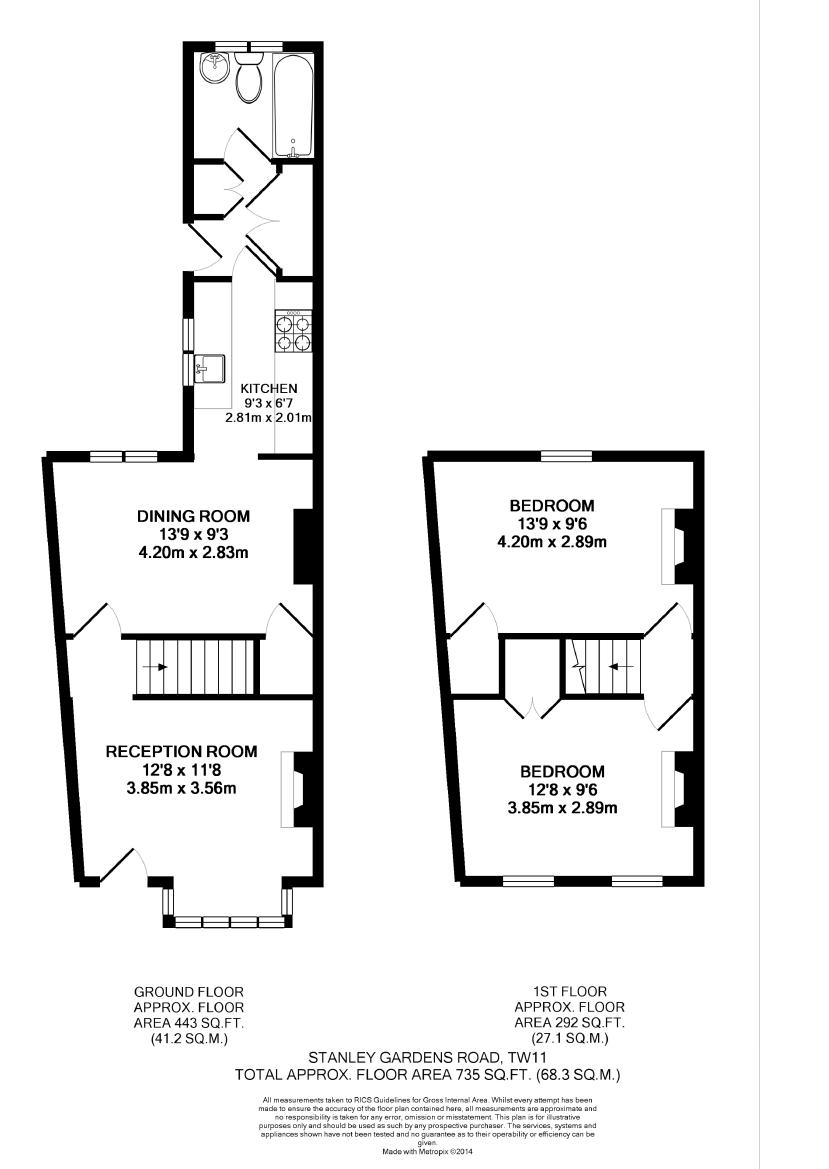

So, here’s what we did….we looked at an example property, analysed the figures and how it would work. We found a really nice, large 3 bed terrace a 10 minute walk from the Uni (just about do-able for students apparently)! It has 2 reception rooms which means you can convert one into a bedroom and the other becomes the house lounge with a separate kitchen. It’s on the market for £375k and, with 4 students living there, you would get an average of £400pcm from each, giving you a gross income of £1600pcm. That gives you a gross yield of 5.1%. Now don’t forget, you’re not getting the income from your own child’s rent but effectively you are, in real terms, seeing as you would otherwise be paying that to another landlord anyway.

Let’s look at the pros of you buying a property for your child at Uni…

- You are investing in property rather than giving dead money to another landlord

- You know your child is living in a nice, well looked after property complying with current regulations (fire safety etc.)

- Your property will more than likely increase in value during your child’s time at university

- You can either sell the property at the end of their Uni course or continue renting to a new set of students.

- You can pass the property on to your child, potentially saving on tax, to get them started on the property ladder

If this is something you’ve maybe been thinking about for a while and appeals to your circumstances then please do drop me an email or give me a call and we can chat about how it can work for you. As part of my business, I can find you a suitable property in any UK University town, make sure you are compliant with all regulations, provide all relevant tenancy agreements and even fully manage the property for you. Effectively a one-stop shop where you can be involved as little or as much as you like.

Rebecca Smith